by Mauro Mortali

•

16 April 2025

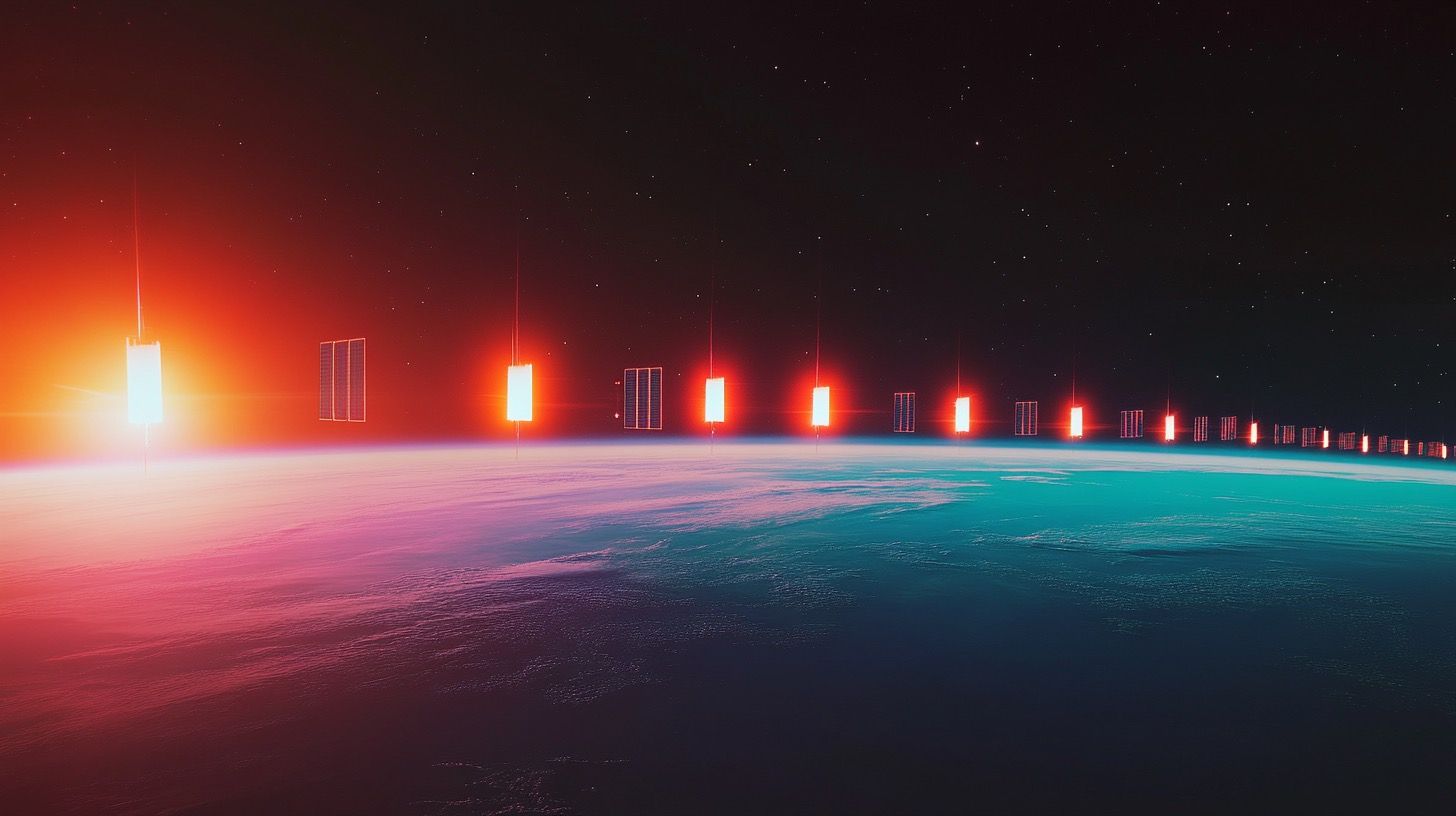

"Is it Snowing in Space?!" “Is it snowing in space?!” Asks a disgruntled Bill Murray in the film Groundhog Day when he is told that he cannot call out from the snowbound town of Punxsutawney, Pennsylvania. If there is a remake, Bill might not have to worry: signal dead zones may soon be a thing of the past due to recent advancements in satellite technology. Whereas the old picture of satellite communications was a scientist in the wilderness with a big clunky antenna, these days the technological payload is all in space. Recent advancements such as Low Earth Orbit (LEO) satellites, advanced beamforming, and the use of mobile spectrum bands means that any phone supporting 4G LTE can potentially receive satellite data directly. This integration of satellite and terrestrial networks is set to reshape the mobile industry, creating both opportunities and challenges for traditional mobile network operators (MNOs) and mobile virtual network operators (MVNOs). In this article we give an overview of the technological advancements, the major players in the market, and then consider the effects this will have on traditional wholesale mobile market structures; concluding with the emerging opportunities for new revenue and growth. The Evolution of Satellite Connectivity Historically, satellite communications operated independently from terrestrial networks, serving specialised markets with limited scalability and high entry barriers. However, recent advancements, particularly in Low Earth Orbit (LEO) satellite technology, have dramatically altered this scenario. The most well-known example is obviously SpaceX, which has played a pivotal role in democratising space: reducing barriers to entry and making satellite connectivity more scalable, performant, and accessible. SpaceX and other companies have found innovative ways to dramatically reduce costs. Since Sputnik 1 in 1957, launching payloads into space has been prohibitively expensive, with costs exceeding $100,000 per kilogram in the 1960s and averaging $16,000/kg for heavy payloads from 1970 to 2010. SpaceX’s innovations have brought these costs down through reusable rockets, vertical integration, economies of scale, and advancements in materials and manufacturing processes: leading to price points as low as $100 per kilogram in recent years. However, cost is just one of the barriers. The real gambit has been provided by Low Earth Orbit (LEO) satellites, which typically orbit at altitudes ranging from approximately 160 to 2,000 km and offer low-latency, high-speed connectivity — making them ideal for real-time applications and direct-to-device communications. The latest generation of technologies now enable LTE mobile phones to connect directly to satellites without specialised hardware, marking a significant milestone in mobile communications. The Major Satellite-to-Cell Players While SpaceX's Starlink has garnered the most attention, several other major companies are actively developing satellite-to-cell technologies and forming strategic partnerships with terrestrial mobile operators. As of April 2024, Starlink had established 15 partnerships with mobile carriers globally — including T-Mobile in the US. T-Mobile has structured its beta program to begin with text messaging capabilities, gradually expanding to include picture messages, data connectivity, and eventually voice calls. As of February 2025, it is reported that 7,086 Starlink satellites are in orbit, with 7,052 being operational. AST SpaceMobile has emerged as a significant innovator, achieving a historic milestone in April 2023 with the first-ever two-way voice call directly with an unmodified smartphone, via their BlueWalker 3 satellite. AST SpaceMobile launched its first five commercial satellites, the BlueBird 1-5 mission, on September 12, 2024, aboard a SpaceX Falcon 9 rocket. Lynk Global represents another significant player. In a recent expense report, it revealed that each satellite costs around $400,000 to build and up to $815,000 to launch into space. They hope to have up to 1000 satellites (for full continuous broadband coverage) in orbit by 2025 and 32 mobile network operator (MNO) partnerships by the end of 2025. The company has successfully demonstrated text messaging capabilities from satellites to standard cellular devices and continues to expand its constellation and service offerings. Huawei has partnered with China Telecom to demonstrate satellite-to-phone messaging capabilities, while Apple has worked with Globalstar to implement emergency satellite messaging features in recent iPhone models. Implications for Traditional Wholesale Mobile Market Structures Traditionally, the wholesale mobile market has been structured around MNOs, MVNOs, and wholesale aggregators. Revenue streams have typically included MVNO wholesale pricing, and IoT and machine-to-machine (M2M) solutions. However, the rise of satellite-to-cell technology poses potential threats to this established model. Disintermediation of MNOs and MVNOs Satellite-to-cell connectivity introduces the potential for disintermediation, where control traditionally held by MNOs could become fragmented across multiple parties in the value chain. As satellite providers increasingly offer direct-to-device services, traditional operators risk losing their central role in network management and customer relationships. Pricing Pressure on Wholesale Markets The increased availability and competition from satellite connectivity providers could exert downward pressure on wholesale pricing. As satellite services become more affordable and accessible, traditional wholesale providers may face challenges in maintaining their pricing structures and profitability. Competitive Pressure in IoT and Enterprise Applications Satellite connectivity is particularly well-suited for IoT and enterprise applications, especially in remote or challenging environments. As satellite-to-cell technology matures, traditional wholesale providers may face intensified competition in these segments, necessitating strategic adjustments to remain competitive. Emerging Opportunities in Satellite-to-Cell Connectivity Despite these challenges, the integration of satellite connectivity into mobile networks also presents substantial opportunities for innovation and growth. Forward-thinking operators can leverage satellite-to-cell technology to develop new business models and revenue streams. Hybrid Terrestrial-Satellite Subscription Models Providing Ubiquitous Connectivity Operators can offer hybrid subscription plans that seamlessly integrate terrestrial and satellite connectivity. Such models provide customers with uninterrupted coverage, enhancing user experience and creating differentiated service offerings. Wholesale Satellite Resale for MVNOs Satellite-to-cell technology opens new avenues for MVNOs to expand their service portfolios. By reselling satellite connectivity, MVNOs can offer enhanced coverage and reliability, particularly in underserved or remote regions, thereby attracting new customer segments. IoT and Enterprise-Focused Applications Satellite connectivity is a natural fit for IoT and enterprise applications, such as remote monitoring, asset tracking, and industrial automation. Mobile operators can forge strategic partnerships with satellite providers to deliver specialised solutions for these markets, tapping into new revenue opportunities. Emergency-Only and Disaster Recovery Plans Satellite-to-cell technology can play a crucial role in emergency and disaster recovery scenarios, providing a reliable backup to terrestrial networks when they are unavailable or overwhelmed. Operators can develop emergency-only plans that leverage satellite connectivity to ensure critical communications during crises. Conclusion Satellite-to-cell technology represents a convergence of space and terrestrial communications systems that promises to fundamentally alter global connectivity markets and players. The dramatic reduction in launch costs by a factor of 20 has enabled the deployment of massive satellite constellations that were previously economically unfeasible. The competitive landscape continues to evolve rapidly, with SpaceX, AST SpaceMobile, and Lynk, and traditional telecommunications companies all pursuing various technological approaches and business models. Commercial text messaging services are already becoming available through beta programs, with video calling capabilities demonstrated and voice calls progressing toward wider availability. The integration of 5G standards with satellite networks continues to advance through collaborative industry initiatives, with projections of a $50 billion market by 2032. As this technology continues to mature throughout 2025 and beyond, it promises to eliminate mobile dead zones and create new application possibilities that were previously unimaginable. The future of mobile communications is undoubtably hybrid: blending terrestrial and non-terrestrial networks into seamless connectivity solutions that follow users wherever they go. This has wide reaching implications for connectivity in remote and isolated regions, and offers perhaps the fastest and most cost-efficient route to bridging the digital divide. It will also transform how we respond in disaster zones and hazardous areas — increasing the ability to protect and save lives with faster and safer humanitarian and emergency services.