Energy & Utilities

Combine Strategy, Innovation & Sustainability

to meet your targets for decarbonisation and long-term growth

We believe that growth and sustainability are not mutually exclusive. With the right strategy, decarbonisation will create revenue opportunities, improve your reputation and inspire your workforce. A realistic sustainability strategy that has the support of your leadership and all your stakeholders is one of the best ways to future proof your business against a volatile energy market and unforeseen environmental and economic threats.

We provide a range of strategy, procurement, and technology services to help businesses in the energy and utilities sector pursue a rigorous decarbonisation strategy backed by data. Our mission is to help you realise your net zero goals in a realistic timeframe while also reducing costs and streamlining your operations.

Decades of experience in the Energy & Utilities sector

Our Energy & Utilities services combine the technical know-how and global reach of Cambridge MC with the energy sector knowledge and data-driven approach of our sustainability sister-company, edenseven.

We offer a tailored package that can link together any number of our consulting services with experts in sustainability to provide the best-fit solution for your needs.

CONTACT THE TEAM

Case Study

Eneco

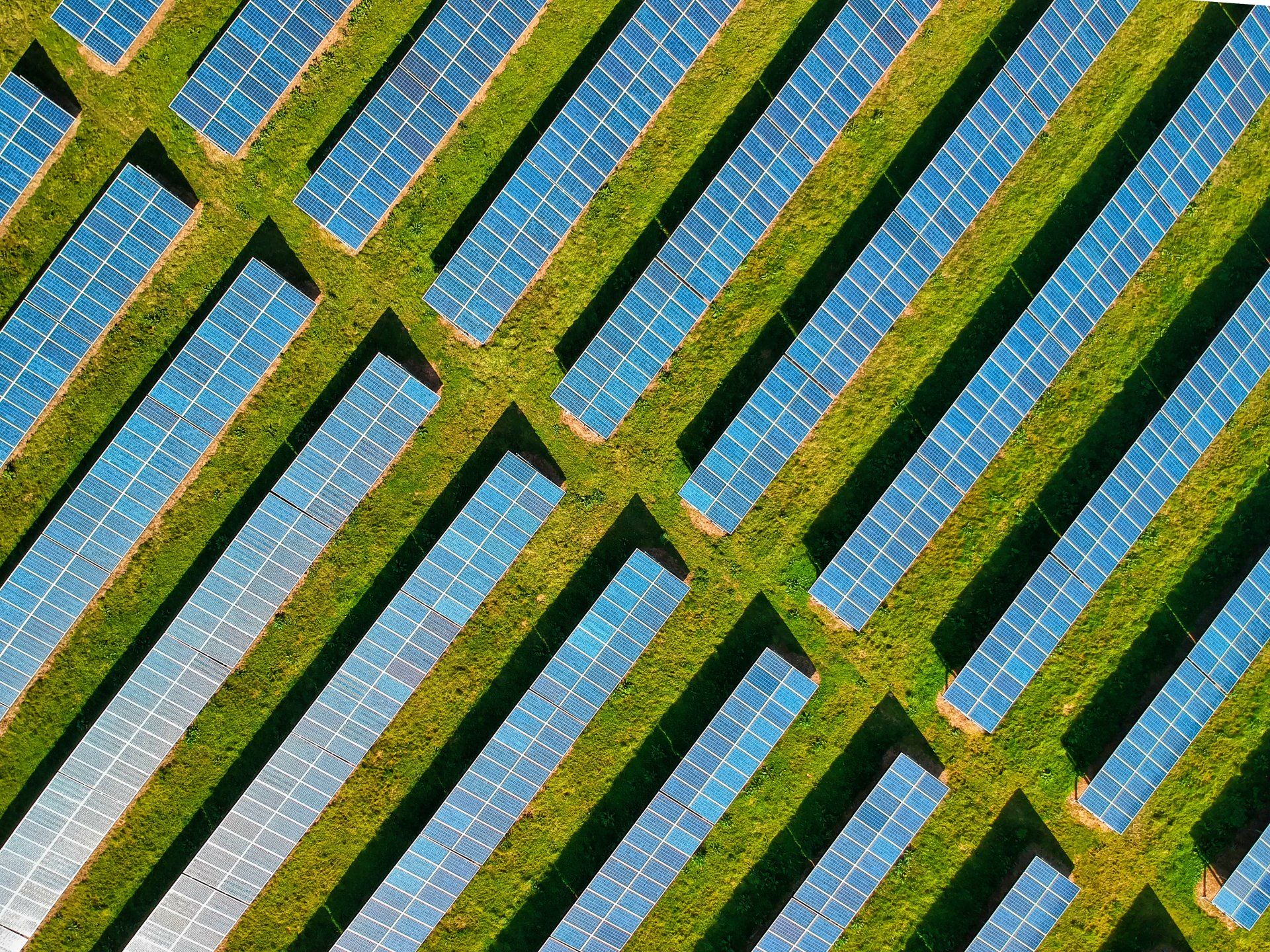

Eneco UK, a subsidiary of Eneco Group, enlisted edenseven, a subsidiary of Cambridge Management Consulting, to tackle a range of decarbonisation challenges to advance their sustainability progress. The main focus was on transitioning towards sustainable energy solutions.

Cambridge Management Consulting implemented a new customer interface, conducted a comprehensive market review, and analysed Eneco UK's customer base for future planning.

The project resulted in a successful interface deployment, precise market analysis, and enhanced customer understanding, supporting Eneco's decarbonisation journey and solar product planning.

How we help our clients

Our global network of experts and partners provide a wide range of strategy and project support to public & private organisations

Sustainability

Focuses on integrating sustainable practices into core operations, optimising resource use, and reducing your carbon footprint.

Strategy

Our global team of experts create detailed and accurate sustainability strategies backed by data analytics.

Procurement

We achieve significant cost savings while promoting sustainable supply chains—contributing to a significant reduction in Scope 3 emissions.

Digital Transformation

We leverage advanced technologies to modernise operations to more sustainable options. We offer digital tools and platforms that enhance efficiency, reduce waste, and optimise resource management.

Project Management

Our PMaaS offers an enhanced ability to achieve strategic sustainability outcomes efficiently, reducing risk and ensuring that projects contribute positively to your sustainability targets.

Change Management

Provides structured frameworks and expert guidance to manage the human and organisational aspects of change, ensuring a smooth transition and integration of new sustainability initiatives.

Cyber Security

Secure by Design security protocols, continuous monitoring & rapid response capabilities to protect against breaches and cyber-attacks. Ensures operational continuity and data integrity, which might otherwise delay sustainability goals.

Energy & Utilities

Case Studies

Our Energy, Utilities & Carbon vertical is led by Pete Nisbet

Managing Partner - edenseven

Pete is the Managing Partner at edenseven. He started his career over 23 years ago working for Southern Gas within their operations team and since then has built a deep understanding of the Energy and Carbon sector, having held senior roles in operations, commodity trading, and portfolio management. Pete most recently held the role of Managing Director for Mitie Energy, where he built an award-winning and market-leading business which provided Integrated Energy and Carbon Services.

The coming years are pivotal in tackling the climate change crisis. Pete believes this will be achieved through effective use of data, deployment of new technology and collaborative thinking.

Our team can be your team

Our team of experts have multiple decades of experience across many different business environments and across various geographies.

We can build you a specialised team with the skillset and expertise required to meet the demands of your industry.

Our combination of expertise and an intelligent methodology is what realises tangible financial benefits for clients.

SPEAK TO THE TEAM

Our Energy & Utilities Experts

Tim Passingham

Non-Executive Director

Tim is the Chairman of Cambridge Management Consulting and Non-Executive Director of edenseven which he co-founded. He has extensive senior executive experience in the information and communications technology industry.

Sustainability Insights

"edenseven's analytic capabilities and industry knowledge delivered a high-quality output that met our requirement and exceeded our expectations"

Carole Coe - Peterborough City Council

"Exceeded our expectations"

Get in touch with our

Energy & Utilities team today

Case Studies

Our team has had the privilege of partnering with a diverse array of clients, from burgeoning startups to FTSE 100

companies. Each case study reflects our commitment to delivering tailored solutions that drive real business results.

CASE STUDIES

A little bit about Cambridge MC

Cambridge Management Consulting is a specialist consultancy drawing on an extensive global network of over 200 senior executives in 22 countries.

Our purpose is to help our clients make a better impact on the world.

ABOUT CAMBRIDGE MC