Digital Infrastructure

Transformative Solutions for Connectivity & Innovation

Helping to Create the Digital Infrastructure of Tommorow

Digital infrastructure projects face significant and complex challenges driven by rapidly evolving technologies such as 5G deployment, OTT (Over-the-Top) and live streaming media consumption, exponential data growth, IoT expansion, and the growing computational demands of generative AI.

These advancements are reshaping both virtual and physical infrastructure, including subsea cables, data centres, broadband networks, and satellite systems.

Our approach has been shaped by decades of excellence and combines a commitment to innovation with unique turnkey solutions for digital infrastructure projects and large-scale challenges. Our services encompass subsea, data centres, broadband infrastructure and satellite, and a broad range of services such as strategy, data & AI, project management, procurement and many more.

We provide tailored solutions that optimise connectivity, streamline costs, and we meticulously plan and execute large-scale projects

We are not just consultants; we are your partners in transformation, dedicated to delivering results that make a tangible difference. Let us help you leverage the opportunities within your sector, so you can thrive in a future defined by connectivity and innovation.

CONTACT THE TEAM

Case Study

Navigating Cloud, Content & Telecoms Markets in the UK

Intro

Virgin Media Business Wholesale Fibre (VMB) aimed to understand the complex and evolving Cloud, Content, and Telecoms (CCT) market in the UK. They engaged Cambridge Management Consulting (Cambridge MC) to analyze this market, influenced by emerging technologies like AI and Edge applications, to gain strategic insights for better product positioning.

Challenge

The intricate CCT ecosystem, with numerous players and constant technological advancements, posed a challenge. VMB tasked Cambridge MC with creating an infographic to encapsulate the ecosystem and a detailed report on the UK market's key drivers of change and evolution, simplifying the complexity into actionable insights.

Approach and Outcomes

Cambridge MC developed an infographic dividing the UK CCT market into four layers: Application, Service, Technology, and Infrastructure, highlighting data and revenue flows. They identified 24 participant groups and over 45 company profiles. A comprehensive report provided insights into the UK fibre and data centre markets and the impact of emerging technologies. These deliverables offered VMB strategic insights to tailor their product design and marketing strategies.

How we help our clients

Our team of experts has decades of experience delivering support to both private and public companies

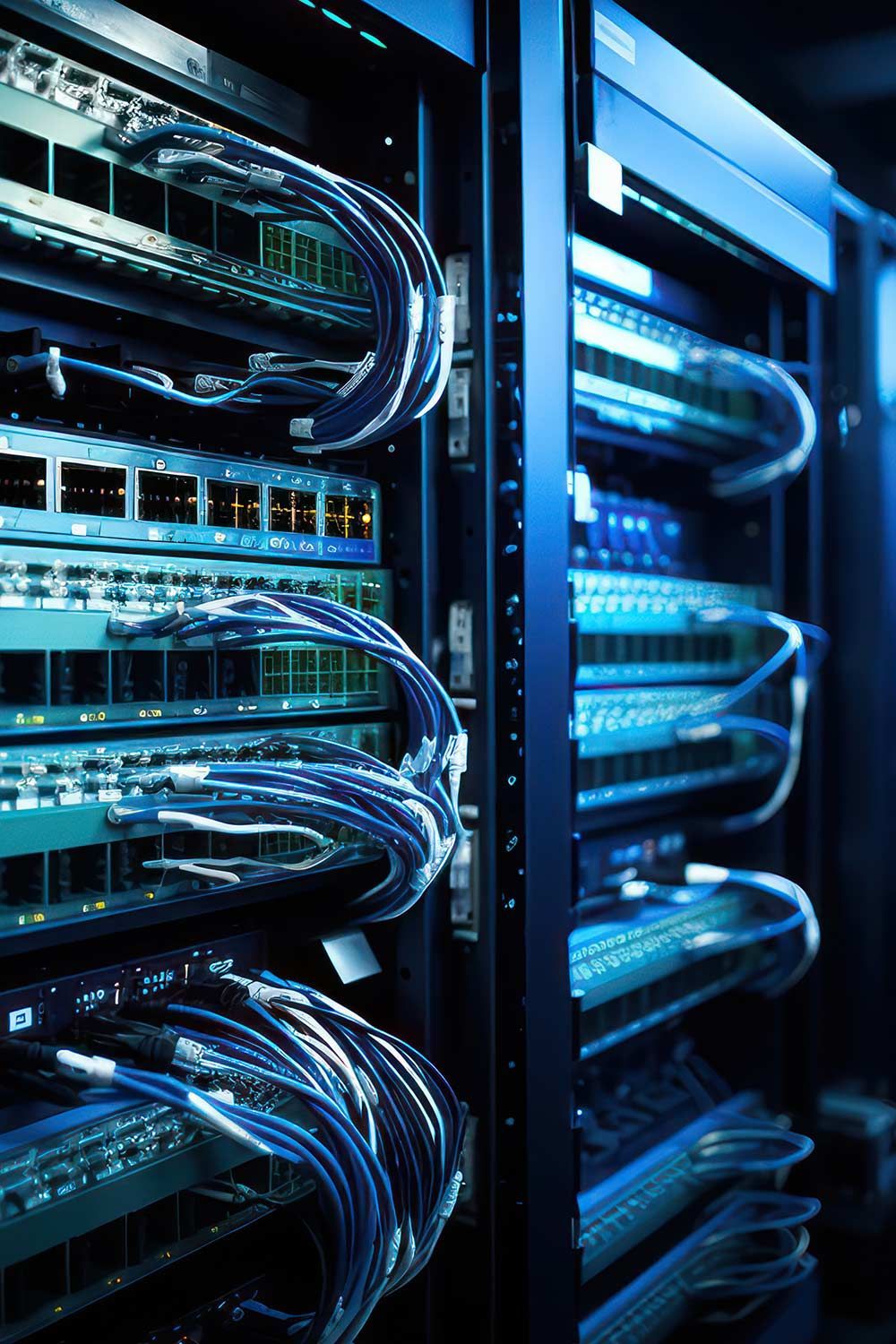

Data Centres, Edge & Cloud

Designing and optimising data centres to handle increasing data loads, ensuring security, efficiency, and sustainability.

Subsea Infrastructure

Developing and maintaining critical subsea communication systems that form the backbone of global connectivity.

Broadband Infrastructure

Building resilient digital frameworks that support the evolving needs of businesses and consumers alike, from fibre optics to cloud-based services.

Satellite Communications

Enhancing global connectivity through advanced satellite solutions that deliver high-speed, reliable internet services to remote and underserved regions.

Contact Centre Transformation & Customer Experience

Modernising contact centres to improve customer interactions; leveraging AI and automation to optimise efficiency and improve customer satisfaction.

PSTN Switch Off Services

We offer a range of strategy, procurement and project management solutions to help UK businesses & the public sector prepare for and migrate their PSTN-dependent services to digital alternatives ahead of the 2027 deadline.

Digital Infrastructure

Case Studies

Our Digital Infrastructure practice is led by Andy Bax

Senior Partner - Digital Infrastructure

Andy Bax, with over 30 years in telecommunications, specialises in digital infrastructure and submarine networks. He's helped develop over 260,000 km of global networks, enhancing connectivity in underserved areas. Andy focuses on stability and efficiency, especially in start-ups, and values the role of people in success.

He began at FLAG Telecom, managing the FEA Submarine System from Europe to Asia. Then, at Global Crossing, he brought submarine networks into service and led major upgrades, also planning Global Crossing's Global NOC.

In 2007, Andy oversaw a 1,240km submarine cable linking Trinidad, Guyana, and Suriname, advising governments to optimise their digital investments. As COO and CSO at EdgeUno, he has concentrated on sustainable growth, reinforcing his expertise in digital infrastructure and subsea solutions.

Our team can be your team

Our team of experts have multiple decades of experience across many different business environments and across various geographies.

We can build you a specialised team with the skillset and expertise required to meet the demands of your industry.

Our combination of expertise and an intelligent methodology is what realises tangible financial benefits for clients.

SPEAK TO THE TEAM

Industry insights

"Cambridge MC helped the University of Bristol complete a multi-million modern network design & procurement, ensuring that University of Bristol remains the university of choice for student, academics and partners in a globally competitive market."

University of Bristol Case Study

"Cambridge MC helped the University of Bristol complete a multi-million modern network design & procurement"

Get in touch with our team today

Case Studies

Our team has had the privilege of partnering with a diverse array of clients, from burgeoning startups to FTSE 100

companies. Each case study reflects our commitment to delivering tailored solutions that drive real business results.

CASE STUDIES

A little bit about Cambridge MC

Cambridge Management Consulting is a specialist consultancy drawing on an extensive global network of over 200 senior executives in 22 countries.

Our purpose is to help our clients make a better impact on the world.

ABOUT CAMBRIDGE MC