The Power of Technology to Boost Investment for Underrepresented Founders

Current Investment Landscape and Shifts

The financial services industry across various specialisations and sectors has undergone a significant transformation in recent years. As highlighted by the Financial Times Adviser, the shift from a pre-COVID-19 world of low interest rates, low inflation, and muted geopolitical risks to a post-pandemic reality of high interest rates, a cost-of-living crisis, and increasing international tensions has reshaped the economic landscape.

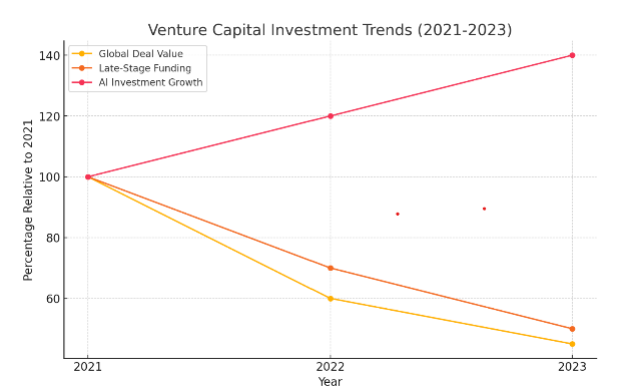

In this evolving environment, venture capital (VC) investment has seen substantial changes, notably a significant slowdown compared to the peaks of 2021. By 2023, global deal values had plummeted to less than half of their 2021 levels, signalling a reversion to pre-pandemic figures from 2018-2020. This decline has been exacerbated by poor IPO performance, which has further restricted access to public markets and diminished the availability of capital for late-stage funding rounds.

Despite these challenges, certain sectors, particularly those centred around AI, have continued to attract substantial investment. The resilience of deals involving generative AI and other emerging technologies underscores a more discerning approach from investors, who are increasingly focused on areas with perceived long-term growth potential.

Overall, the VC landscape has become more demanding, with a heightened emphasis on strong fundamentals and profitability as investors exercise greater caution.

In response to this shifting environment, Cambridge Management Consulting has partnered with composability, an innovative AI-driven deal advisory firm specialising in tailored investment readiness support for technology start-ups and scale-ups. Together, we have co-developed a pioneering approach to technical due diligence, setting new industry benchmarks designed to help founders raise capital more efficiently and enable investors to deploy funds more accurately and successfully.

Additionally, Cambridge Management Consulting is proud to sponsor Cambridge Tech Week this year. On Tuesday, 10th September, we will be focusing on Innovation & Investor Day, where we will showcase our expertise in these areas. We will be sharing a stall on the Innovation Alley with one of our esteemed partners, composability.

Recently, we sat down with Ian Jarvis, CEO and founder of composability, and Elise Elan, Chief Strategy Officer, to discuss current shifts in investment trends, particularly the impact of technology and its role in levelling the playing field for start-ups that often begin their investment journey at a disadvantage.

Accentuated Challenges for Underrepresented Founders

In addition to the fluctuating venture capital scene and recent challenges outlined above, the lingering practice of basing investment on human-led, subjective decision-making processes continues to dominate the industry, in which prejudice against underrepresented founders becomes most manifest.

Lolita Taub, General Partner at The Community Fund, explains, “We all have biases. This is one more reason we need to have women and underestimated minorities be check writers. It’s all about who’s writing checks and seeing these opportunities.”

Artificial Intelligence, Real Decisions: The Role of AI in Investment Decision-Making

Diversity VC, a venture capital firm that advocates for underrepresented founders, highlights the pitfalls of subjective decision-making, particularly the practice known as "pattern matching." This approach involves investors seeking out and funding founders and organisations that resemble previously successful companies. While this can be effective in theory, it often creates an echo chamber that excludes underrepresented demographics who don't fit the traditional mould that investors are looking to replicate.

This is particularly problematic given that minority-led companies often demonstrate qualities highly valued by investors today, such as cash efficiency and low burn rates. For instance, within the Open Fund portfolio, 57% of companies are Black-founded, and these companies are experiencing an average of 100% year-over-year revenue growth. As Diversity VC succinctly puts it, "pattern matching is the enemy of innovation."

We are now at a turning point in both the investment ecosystem and the broader tech landscape, driven by the rapid emergence and evolution of Artificial Intelligence (AI). This topic is a major focus during Cambridge Tech Week, particularly on the third day, which will be dedicated to Tech Deep Dives and include discussions and debates on what it's actually like to work with AI on a day-to-day basis.

AI is considered one of the most promising macro trends among investors, offering two primary benefits to investment practices:

- Streamlining Portfolio Risk Analysis: AI algorithms can analyse vast amounts of data, providing insights that would otherwise require meticulous and time-consuming assessments.

- Informing Decision-Making: More significantly, AI-driven insights can shape and enhance decision-making processes within the investment landscape.

However, given the absorptive nature of AI and machine learning (ML) platforms, there is a risk that AI could inadvertently reinforce the pattern-matching bias within the investment process. Recognising this, composability has conducted extensive research and development to harness AI's innovative potential while mitigating its biases. Their AI platform focuses solely on the facts, ideas, and plans of a startup, deliberately avoiding distractions and subjectivities related to the founders' backgrounds. This approach ensures that founders are matched with investors based on aligned criteria, rather than superficial similarities.

composability is at the forefront of innovative AI use through its AI platform and Investor Ready program:

- AI Platform: The platform conducts financial modeling, investor matching, and readiness scoring, avoiding bias and focusing purely on the startup’s potential to align it with investors’ criteria.

- Investor Ready Program: This program offers strategic preparation by aligning the startup's vision with investor expectations. It includes pitch development, due diligence, and strategic planning, setting a solid foundation for a successful investment journey.

- Comprehensive Analysis: The program starts with market analysis, financial reviews, and team evaluations, crucial components of the Analysis & Scoring system. These are documented in Confidential Information Memorandums (CIMs), providing transparency and detailed insights into a startup’s readiness.

- Ongoing Support: Throughout the program, composability uses AI to match startups with suitable investors while offering personalized advisory support, financial modelling, and strategic marketing advice to enhance the startup’s positioning.

composability's multi-AI-agent platform leverages advanced AI to ensure startups stand out with precision, efficiency, and tailored strategies. This not only increases the likelihood of securing funding but also

uses AI to break through the barriers perpetuated by traditional pattern-matching practices.

Opportunities and Future Directions

We are proud to support composability, one of the most innovative and forward-thinking organisations revolutionising smart fundraising for a successful investment journey. Their efforts, along with those of other key players, are instrumental in helping underrepresented founders overcome existing barriers. Notable organisations leading this movement include:

- Diversity VC: Providing guidance to underrepresented founders and promoting equity and inclusion within the venture capital industry.

- The Future Fund: A government initiative managed by the British Business Bank, established to support UK-based companies facing financial challenges due to the COVID-19 pandemic.

- CrowdCube: A platform that fosters investment in European start-ups, with a strong emphasis on diversity.

- ImpactX: A London-based venture firm dedicated to driving social change through successful venture investments.

- Riceberg VC: A deep-tech investor with an impact fund, focusing on creating opportunities for underrepresented founders.

These organisations are at the forefront of a growing movement to make the investment landscape more accessible and equitable for underrepresented founders. Ian, Elise, and the composability team are committed to guiding such companies toward these opportunities and preparing them for their investment journey.

To find out more about composability's services to support start-ups at all growth stages visit https://composability.co.uk/ and request a free consultation.

For more information on Cambridge MC and how this partnership can benefit your organisation, contact David Lewis using the form below.

Come and meet us!

Cambridge MC and composability will be attending Cambridge Tech Week (9-13 September). You can register here: https://cambridgetechweek.co.uk/.

Meet us at the Innovation & Investor Day and at our shared stand at the innovation alley

Hear from Duncan Clubb, Senior Partner for Cambridge Management Consulting, who will be taking part in the panel:

The Stages of Adoption from R&D and Spin-Outs to Enterprise. This will go into detail regarding ‘how, why, and where businesses are adopting AI with experts from R&D innovation projects, scale-ups, and big corporates’

Contact - Beyond the Bias

Subscribe to our insights

Blog Subscribe